|

Larry: |

I hold the stocks of well-managed, large companies which have grown significantly, but I have large losses. |

| Barry: | Why do you have losses if the companies are successful? |

|

Larry: |

Because I bought the stocks at the wrong time, when the market had them valued at much higher prices. |

| Barry: | When you bought them did you limit your downside by placing stop-loss orders with a broker, or predetermining the amount you were willing to lose before selling them? |

|

Larry: |

No, I didn’t and why would I do that? |

| Barry: | Because stock prices can go down as well as up, and it is only by selling the stocks which are losing value that you can preserve your capital, to be used when market factors are more favorable. |

|

Larry: |

Sure, but stock prices can always be volatile, and the market will eventually go up. Isn’t that what everyone believes? |

| Barry: | No, it is not what most professional investors, who are responsible for protecting and enhancing other people’s money, necessarily believe. They accept the fact that stock prices can decline, but the top investors do not just continue holding losing positions. |

|

Larry: |

I guess that you are right, and if I had sold the stocks at higher prices and held the cash, I could now buy more shares of the same companies at their lower prices. |

| Barry: | Right, and how did you decide how much of each of the companies to buy? |

|

Larry: |

No specific way, I just bought a roughly equal dollar amount of each stock when I had the money to do so. |

| Barry: | A professional investor would probably have decided on the relative size of each portfolio holding using some measure of value, such as P/E or current growth rate of revenues. |

|

Larry: |

That makes sense, but I don’t have the same level of information or time to spend on making these judgements as professional investors do. |

| Barry: | Right and neither do I and nor do most individual investors. That’s why it’s better for us to invest in mutual funds or Exchange Traded Funds (ETFs). |

|

Larry: |

But that’s not as much fun or exciting. Also, I only want to be involved in companies having certain characteristics. |

| Barry: | There are funds which invest in the same characteristic companies as are of interest to you. Also, are you having fun now and enjoying the excitement of losing money? |

|

Larry: |

Yes, but don’t the funds also go down with the market and would I therefore lose money by investing in them? |

| Barry: | Absolutely, but the difference is the losses could be less and the mix of holdings better researched and determined. |

|

Larry: |

How do I learn which funds have better records of performance? |

| Barry: | Brokers can research the fund performance ranking service I created, and further developed by his brother, Mike Lipper. |

Arthur Lipper, chairman arthurlipper@gmail.com

British Far East Holdings Ltd.

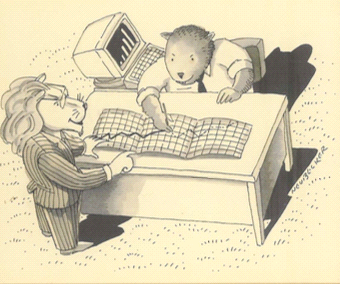

* Lawrence (Larry) Lion and Bernard (Barry) Beaver have been used to illustrate the reactions of growth-focused entrepreneurs to new ideas. Larry and Barry first appeared in my monthly Chairman’s / Editor-In-Chief column of Venture, The Magazine for Business Owners and Entrepreneurs. I have also used them in several books on entrepreneurship and royalties, as well as in many opinion columns.