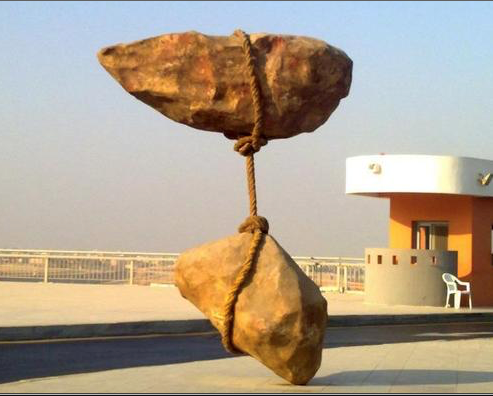

This impossible appearing sculpture above is at the Cairo Airport.

The ways the inherent benefits of royalties are created is also difficult for some to understand

The explanation of both follow

Royalties are an agreed percentage of a company’s defined revenues. The royalty issued by the company, as an issuer, is for an agreed period or cumulative payment amount.

There are only three things which can go wrong for an investor. These are

1) the royalty issuer is not able to meet its obligations to the investor,

2) the revenue growth of the issuing company is less than projected, or

3) the investor paid too much for the royalty relative to the return.

From the royalty issuer’s perspective, the risk is that the royalty payment obligations are burdensome, especially if the revenues projected and profits derived therefrom, are less than expected.

Royalties, representing a percentage of the company’s revenues and not of the ownership of the company, are not restrictive of the way the company owners manage the company.

The royalties we recommend have a clause granting the royalty issuer a right of redemption which permits the company, on agreed terms, to terminate the outstanding royalties.

The royalty investor will want an Internal Rate of Return (IRR) in the 15% to 20% range, depending on the investor’s assessed risk level and the industry, stage of product development and other characteristics of the company.

Investors should only invest in the royalties of companies where there is a reasonable expectation of revenues increasing substantially over a ten to twenty-year period. The shorter the term of the royalty the higher will be the royalty rates required to generate the investor’s minimum target return.

The level of cumulative royalty payments can be assured by the company or endorsed by an independent entity. However, the shifting of risk from the investor to others will result in a lower royalty rate being offered, as the risk will have been reduced or eliminated.

The owners of the royalty issuing company have an overriding advantage which motivates the use royalties instead of raising growth capital by selling stock in the company, If the company will be successful the company will be worth more in the future that currently and the owners will have retained all of the ownership, as well as full control of the company.

The royalty investor’s interest is protected in a number of ways, using our approaches. It is also to be expected that with the company’s increasing revenues, the return will be much higher than other alternative forms of investment. Of course, due to the royalty payments being paid immediately on receipt of revenue (which is what we recommend and is in our U.S. patent covering our approaches), reduces risk for the investor.

For more information regarding royalties see http://REX-Basic.com, http://arthurlipper.com or read “Revenue Royalties” or “Off The Top”, both available from http://Amazon.com.

The following graphic is suggested as being the hidden support structure for the wonderfully imaginative sculpture. Also, the stones could be hollow and be other than “stones”.

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

858 793 7100

Blog Management: Viktor Filiba

termic.publishing@gmail.com