Projecting a company’s future trend of revenues is far easier than projecting future earnings per share. It is even more difficult to predict the future market price of a company’s shares if they are publicly traded.

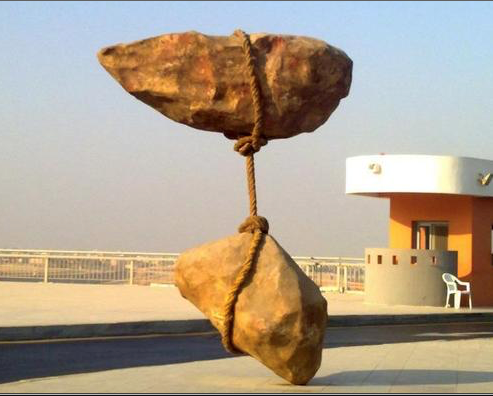

The sculpture pictured above is at the Miami airport. It captivated me, as I have a need to understand how things work and are possible.

Investing in the stock of a company is a bet on the future profitability of the company and the expectation at a future time of the aggregate assessment of other investors as to the likely growth of that profitability. Profit declarations are discretionary, especially in the case of privately-owned companies. The management of publicly traded companies almost always wants to report the highest per-share profits possible, so the price of the stock will rise.

The owners of privately-owned companies frequently prefer management strategies resulting in longer term benefit for the company and the lowest reportable and taxable current profits, consistent with accounting treatments approved by their lawyers and accountants.

On the other hand, investing in revenue royalties linked to the likely future revenues of a company requires an understanding of the relative benefits being provided to the company’s customers. It is a competitive value analysis. If the company’s products represent value to the customers (and that knowledge should be evidence-based and ascertainable), then the revenues of the company will increase as the sales to the company’s customers increase. Therefore, it is necessary for the royalties investor to have an independent view of the economic prospects for the company’s customers in reaching a judgement as to the company’s projections of future revenues.

Investors in the stock of companies also need to have a view as to the company’s cost of materials and labor, as well as other factors that impact profit margins.

Royalty investors, who are principally concerned with revenues, want to be assured of the issuing company’s contractual compliance — first, to pay the royalties when revenues are received and second, the reasonableness of the company’s projected growth of revenues.

Therefore, the royalty investor should be aware of the economic health and prospects of the company’s customers and of course, the company’s ability to continue benefiting its customers by delivering value. Royalty investors have an easier task of verifying their potential future returns on investment than equity investors, and will benefit from royalties received immediately, well before stock investors receive more than a possible paper profit.

The mechanics we recommend for the calculation of the royalty-issuing company’s defined revenues and the assured payment of the agreed-upon royalties are specific and functional, and easy to calculate using a set of analytical tools introduced at royalties.website.

Royalties are simply the better way of both investing in and financing privately-owned companies.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

+1 858 793 7100

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com