Revenue sharing originated as an arrangement whereby those with the right to control particular assets benefited when others wanted to use those assets. This was the case with land, vessels, equipment and other property. The payment for the use of those assets was called a royalty, because historically it was the monarch and his appointees who had the ability to grant the right to use the property.

This was the general situation before the evolution of intellectual property rights reflected and protected by patents.

Royalties also were an important means of profiting from assets before the magic of company incorporation was discovered in the 17th century, enabling a company’s percentage ownership to be bought and sold–which made it possible for prospective profit sharing to replace revenue sharing as a means of investment.

Those who envisioned establishing commercial activities required capital investment, and investors were offered a percentage of the ownership of the business, which was equivalent to a percentage of the profit and reflected value of the business. In some cases, there was a percentage profit sharing through the distribution of dividends, as declared by the shareholder elected board of directors of the company. As the company typically required increasing amounts of money to grow the business the dividend declarations were but a portion of the profit earned by the company. Some companies declared a large percentage of profits earned and others chose to retain in the company all of the profit earned for the financing of the future growth of the company,

Currently, those individuals seeking to create businesses usually follow the standard process of attempting to finance their new endeavors by selling significant segments of the ownership of their business. They, of course, also anticipate to personally benefit from employment in the company and from sharing in the anticipated increase in value of whatever percentage of the company shares they are able to retain.

The problem is that frequently their employment opportunities are negatively impacted by outside shareholders and their anticipated profits are minimized because their interest in the company is heavily diluted, resulting in disappointment and frustration, even if the company becomes successful.

One attractive alternative may be to finance the company through revenue sharing, permitting the company to remain privately owned and perhaps continue to be, even for only the earliest of stages of the company, a proprietorship.

A royalty financed business should be one which is or plans to be highly profitable. It should also be one which can meet most of its growing financial needs from internally generated capital, because the royalty will probably need to be redeemed at some point in the future in response to the demands of new investors. The early stage royalty financed company can use the standard profit-sharing, equity-selling approach once it is able to generate significant profits, and then on far more favorable terms.

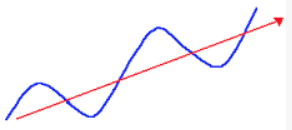

Financing business activity through revenue sharing originated long before the current profit-sharing, equity-selling approach. Today we have returned to an economic cycle where royalty finance can offer so many advantages to the business founder.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

+1 858 793 7100

©Copyright 2020 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com