Let’s assume that your company is already doing fine with increasing revenues. However, if additional working capital was available the marketing effort could be expanded, an additional office could be established, or another company could be acquired.

Of course, there are two conventional possibilities, one being borrowing money and the other selling some stock in the company. Both have cost and problems.

The new idea for a possible deal to consider might be the sale of a royalty based on the results of using the money received for the royalty. In other words, the current level of revenue would not be used in the calculation of the royalty payment. The royalty would be based on the revenues which were generated in excess of the current level of revenue.

Of course, you would want and there should be a royalty issuer right of redemption, terminating the revenue sharing obligation. The cost of the issuer’s ability to terminate the royalty deal would be a multiple of the amount paid for the royalty, less the royalty payments made in successive periods.

The terms negotiated could be that the amount of money paid for the royalty could be at least doubled, 2X if the redemption occurred in say, 24 months and be 3X times the amount paid, if the redemption right was exercised in 3 to 5 years of the original purchase of the royalty. In all cases, royalty right of redemption would be for an amount less the royalties having been paid to the royalty investors. Therefore, if the original deal was that of a revenue sharing royalty with a 5% royalty rate of the incremental revenues which was paid to the royalty investors, that deal would continue for the ten years initially agreed, unless the royalty was redeemed and terminated.

There would probably have to be an agreement that the royalty continued for at least the amount of time that the revenues in excess of the original level that royalty payments were made sufficient to provide the royalty investor with an Internal Rate of Return (IRR) of say 10%.

Therefore, the deal would be that the amount of money believed by the business owners would be used to result in a substantial increase in revenues was made for 5% of revenues greater than at the time of original contract, for 10 years. If the royalty was terminated the return to the investor would be much higher than the agreed 5% of revenues.

In the event the revenues were disappointing , the royalty payments would continue past the agreed 10 years, until the investors had received at least a 10% IRR for as long as necessary for the investor return to be achieved.

That’s the possible deal, 5% of royalty payment enhanced revenues for 10 years, unless terminated by the royalty issuer within either 2 or 5 years, less royalties paid, with the 5% of revenue royalty payment obligation continuing until the investors receive a 10% IRR.

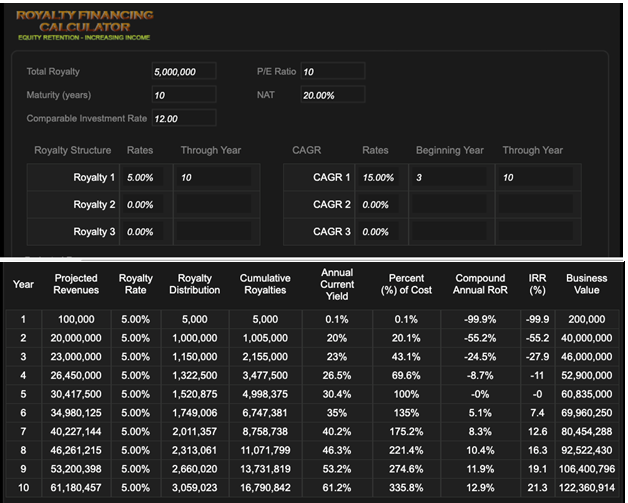

Following is the Deal tabular refection of the deal using our rex-basic.com/ website calculator. This is the deal for the projected in excess of $10 million in revenue. The assumptions used are: $10.0 million of pre-deal annual revenues, with $5.0 million sought in anticipation of a 2-year doubling of revenues in 2 years and a Compound Annual Growth (CAGR) of revenues of 15% for the 8-year balance of the 10-year period. Also assumed is a 20% Net After Tax margin and an estimated 10 P/E for comparable publicly quoted companies.

In the following investor’s Deal analytics (a similar table for the issuer would show the results of increasing the revenues by $20 million in each of the years) shows the investor would have received a minimum IRR of 41% if the 2X redemption right was exercised and $10 million paid. Were the issuer to wait until the end of the 5th year to exercise the right of redemption the 3X payment would be at least $15 million for a 25% IRR. Therefore, it is far more likely the issuer would redeem the royalty by the end of the 2nd than 5th year.

It must be understood that the royalty is only paid on the growth of revenues over those at the time the royalty was purchased. Therefore, the owners of the business are not paying a royalty, in this case, on $20 million of revenues in each or the ten years.

Of course, the owners of the company may, at any time, seek to redeem the royalty for whatever amount they believe reasonable. The investor is, however, only required to accept the offer as stipulated in the right of redemption.

There are other features which may be used in making this sort of “revenues in excess of X” even more attractive to both investors and issuers.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

+1 858 793 7100

©Copyright 2020 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com