Business founders and owners can relax as royalty Investors only need to be convinced as to a positive future revenue trend to be interested.

Royalty investors have an easier task of agreeing to a business owner’s projections of revenues if the investor has done the necessary research. The research must start with an understanding of why the company seeking funding has or can create a better solution to the needs of a sufficiently large body of prospective customers. The product or service must represent value to the customer and be better than competitive products or services. There are probably those with direct industry experience who can advise the investor.

The projection of a company’s revenues in most cases are dependent on the growth of the company’s customers, certainly in a business to business (B2B) relationship. Growing revenues by a company is a lot easier if the company’s customers are also growing.

The royalty investors is not interested in the company’s profitability, except as relating to the company’s sustainability. Also, the royalty investor is not interested in the issuing company’s ideas of fair valuation or a subsequent market valuation as the royalty investor never owner other than the agreed percentage of revenues.

The terms of the royalty must include investor protections sufficient to justify a reasonable royalty rate, even in the event of revenues being somewhat less than those projected by the company selling the royalty.

To be fair, the terms of a royalty should also provide the royalty issuing company with a right of redemption, whereby the royalties can be redeemed and therefore terminates, on terms agreed at the time of purchase. The terms should be multiples of cost, less royalties paid, depending on the time of exercise.

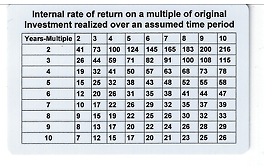

The Internal Rate of Return (IRR) table following indicates that a 5 fold return in 5 years is a 38% IRR and a 10 fold return in 10 years is a 26% IRR.

As the terms include the royalty payments made as a part of the multiple, the effective Royalty Rate of Return (RRRR) is higher as a part of the return was quicker than the calculation being only that of the beginning to ending point to point. RRRR’s will always be higher than IRR’s.

The RRRR feature is part of the calculation in our http://REX-RiAR.com calculator along with several other features of Royalty Issuer Assured Return (RIAR) approach. The website calculator has been recently upgraded and modified and is likely to become a standard approach.

Therefore, the frantic business founding owner depicted above can relax if he can convince an experienced investor that projected revenues are achievable and will produce more than satisfactory investor returns. If he cannot then he should sell stock to whoever he can as he is likely, if fortunate, to be a senior officer and very small owner of the business, if it succeeds. Had he sold a royalty to fund the company and the company was successful, he would have been happier and richer.

For more information about royalties contact:

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

858 793 7100 (Pacific time)