Investing is an artform, not a science, in which success is achieved when the amount of return is realistically analyzed and concluded to be significantly greater than the risk of capital loss.

The above statement is true if the investment is in a royalty income fund comprised of a diversified portfolio of revenue royalties issued by established companies having a recent record of increasing revenues. The amounts paid for the royalties will be calculated as a percentage of the future royalties of the companies. That percentage will be adjusted according the industry of the customers of the royalty issuing companies and the profit margins of the royalty issuers. Of course, the magnitude of the projected revenue increases, assuming the company is successful in selling a royalty on the terms sought, will determine the likely level of investor attraction.

In the royalty agreements we recommend there is an assignment of the royalty issuing company’s critical assets that are essential for it to operate. This enables investors to take remedial action in the improbable event that the company receiving revenues does not make an immediate payment of the agreed royalty to investors.

If a royalty structured as we recommend provides at least a 15% Internal Rate of Return, over the course of the royalty investment period, this represents an excellent investment and a logical inclusion in a royalty income fund’s portfolio.

Due to the issuer’s right of redemption, which we recommend as a contract provision because it is fair and attractive to business owners, companies wishing to terminate the royalty will pay a premium to do so and therefore increase significantly the rate and speed of the return received by investors individually or in a royalty income fund versus that originally anticipated.

We believe that most successful companies will be pleased to exercise their redemption right, terminating the royalty, in the event of: a business success-based refinancing, an ability to go public or a will require sale or merger of the royalty issuing company.

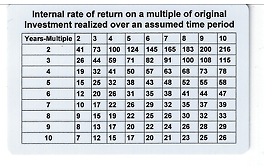

The terms of the redemption right will require the company to pay the investors an agreed multiple of the original cost of investment, less the royalties paid during an agreed period. If the terms require a payment of 5 times the original cost of the royalty if exercised anytime within 5 years, the company would be required to pay the investor 5 times the investor’s cost inclusive of the cumulative amount already paid. The royalty payment obligation of the company would be terminated and the investors would have received more than a 38% Internal Rate of Return (IRR). The “more than” is due to the assumed reinvestment of the quarterly royalty payments as received. The Reinvested Royalty Rate of Return (RRRR) is always going to be greater than the IRR, which is an acquisition point to sale point measure.

Following is a 10-year Internal Rate of Return table which is also found on the back of my business card. It chart shows that a 10-fold return in 10 years is a 26% IRR. A full 20-year IRR table can be found at the REX-Basic.com website calculator

Therefore, it is reasonable to believe that there is little portfolio capital risk in royalty income funds investing in the royalties of established companies and that superior alternative investment returns can be expected from a portfolio of royalties.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

+1 858 793 7100

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com