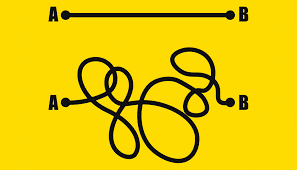

A could be a location and B a destination.

Getting to A requires an investment of something. It could be time, effort or money.

If not walking, which requires time and effort, a vehicle is required. The vehicle could be a car or a combination of car and train, plane or ship.

Owning the car, train or ship is not necessary to have the function and advantage of the car, train or ship available.

If the car, train or ship is owned by other than the user there will likely be a charge made. The charge will be more than the owner of the car, train or ship believes is the cost of transporting the passenger, If there are enough charge paying passengers the difference between the aggregate cost and total amount of money received will be profit. The cost of providing the service will include: depreciation of the cost of the car, train or ship, equipment maintenance, space and facilities used, wages paid, financing costs, insurance and taxes. If there are not sufficient passengers using the car, train or ship in any trip there will be a loss for the provider of the service.

In some cases, owners providing the use of cars, trains and ships have made a lot of money and in other cases losses have resulted.

A could also be the amount of income being currently earned by an investor and B the amount of income the investors wants to receive. Of course, the investor wishes to have as much income possible with accepting as little risk as possible.

The investor can invest in government bonds or other debt obligations. The investor can also purchase annuities or a range of different income funds. An investor wishing to be more actively involved in the income earing process can become a landlord or lender to companies or individuals. Finally, the investor can become an owner and/or operator of businesses.

In each of the cases involving business ownership there is the possibility of loss, as well as gain. If the ownership interest is publicly traded there is capital risk based on the amount paid for the security

If A is the amount paid for a revenue royalty, a percentage of a company’s defined revenues and B is the earning of at least an Internal Rate of Return (IRR) it is not necessary for the investor to own any part of the company issuing the royalty.

The royalty investor’s results will depend on both the success of the company in achieving growing revenues and the terms of the royalty agreement.

At no time will the royalty investor become an owner of the business having sold the royalty, even though the payment obligation of the royalty issuing company can be secured by assets of the issuing company.

The royalty investor is basing the investment on an assumption of the sustainability of the royalty issuing company and continuing losses are therefore of concern to the royalty investor. However, there are situations where companies are able to report losses, due to depreciation and timing of revenues, and still be viable and increasing in value. This is true in some real estate developments and in some professional sport teams and in some intellectual property creative enterprises.

Nevertheless, those considering royalty investment should be attracted to companies which realistically expect to generate increasing revenues and be able to so while earning a good profit, so royalties can be paid without creating negative cash flow.

Those professionally managing money should have targeted IRRs for investments intended to generate income and the targeted IRR becomes the B which is sought.

Royalties can have minimums and can be assured as to the level of minimum payments to be received in agreed periods. There is, however, a correlation between the level of investor returns and assurance of receipt. The closer an investment is to that considered by the market to be riskless, the lower is the return, as the assurance requires either the payment of a fee to an independent assuror or the management of the royalty issuer in a more conservative manner than that which might result in larger and faster growth.

Using our proprietary website calculators and ourselves as advisors’ investors and issuers will be able to balance the capital use and payment assurance needs of the parties.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

+1 858 793 7100

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com