The answers are yes and no.

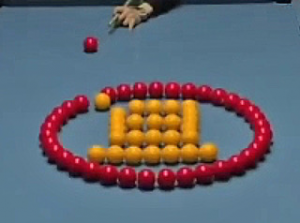

Trick pool shots are remarkable and can be Googled. I will forward the series I received to anyone so requesting.

Revenue royalties, an agreed percentage of a company’s revenues generated in an agreed period, are simple and straight forward. Royalties are also the better way of companies raising working capital, especially when the owners of the business believe the market value of the business will increase and if they wish to avoid equity dilution.

Royalties are also better for the capital providers, and we have been able to patent some of the approaches we have developed for revenue royalty financing.

Royalties can be structured to increase in value as the revenues of the royalty-issuing company increase. The royalty rate, the percentage of total (or otherwise-defined) revenues, can be scheduled to be adjusted according to the level of cumulative revenue payments received by the royalty investor.

Royalties can also be terminated by the royalty issuer exercising a right of redemption if this option has been included in the royalty terms.

Royalties are typically paid by the issuing company immediately on receipt of revenues. The terms of a royalty agreement are based on the projection of revenues made by the royalty issuing company. They can, but do not have to be, assured by the company or a third-party guarantor. Royalty terms can also be structured to reward companies generating greater than projected revenues. The more attractive the terms of a royalty for the investor the lower can be the negotiated royalty rate.

We are in business to advise and assist both royalty issuing companies and investors seeking higher returns resulting from financing growing companies.

Arthur Lipper, Chairman arthurlipper@gmail.com

British Far East Holdings Ltd.