I have recently been made aware that some startup entrepreneurs are making propositions to investors promising that in 36 months they will receive returns that are multiples of the amount invested. These assured payments of X times investment cost range from 2.5 times to 8.4 times the investor’s cost of the royalty. Of course, the terms of a royalty can be whatever are agreed by the parties to the transaction and may be changed during the contract period by the consent of the parties.

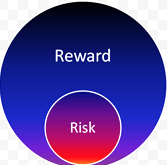

In simpler terms, this approach represents a bet by the investor, who pays the agreed amount for the royalty and expects to receive, within 36 months, the specified cumulative amount in royalty payments based on a percent of gross revenues. The investor is assured of the cumulative payment regardless of the scale of revenues actually achieved by the royalty issuing company.

Stated differently, while still viewing the transaction as a royalty, and not a loan, the royalty issuer is offering an assured 36-month cumulative amount of revenues, which is necessary to pay the agreed multiple of the investor’s cost of the royalty.

The terms of this Assured Result Revenue Royalty (ARRR) will also include the issuing company’s payment of a fee to a guarantor of the ARRR. The rationale for this guarantee is that the more secure the investor is in receiving the specified multiple of cost, the lower that multiple of cost offered is likely to be.

Although this particular structure does not offer the traditional benefit of a longer-term stream of revenue royalties, it is possible that ARRR transactions will begin to play an important role in the financing of companies that have specific short-term business objectives and expectations which require and justify high-cost financing that may be dramatically profitable for investors.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

+1 858 793 7100

©Copyright 2020 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com