Preface:

Many years ago, when I retired from being the Chairman and Editor-In-Chief of Venture, The Magazine for Business Owners and Entrepreneurs, a national champion of the importance of entrepreneurship, the objectives of business formation were very different than they are for many today.

The image of the successful entrepreneur then was the courageous and driven individual, having both a vision and a mission to create a for-profit enterprise offering a new and better something which had value to users and produced a profit for the provider. Continuing and growing the business was the objective of the founder and achieving a positive cash flow and profit were both necessary.

This was how an entrepreneur was then depicted:

and this is how a business owner on Christmas eve was depicted:

Today, as so many startups are technology creating and improving there is both an assumption that once proof of concept is established the enterprise will have the opportunity to “exit” by selling the company to a business which has the capital and marketing ability to profit from the creativity of the startup company and its personnel, some of which will remain with the acquired company. Indeed, the exit has become the strategic objective and the structuring and financing of the company reflect the anticipated and sought-after exit.

Certainly, the equity investors, having financed the startup, would be pleased if the company was able to make sufficient technological or developmental progress to become an attractive acquisition target for larger companies. Indeed, the company’s investor pitch and investor’s rationale for investing is in many cases the exit, which can include the making of a public offering of shares of the company at a higher valuation.

There is no purpose of discussing, in this essay, the societal overall result of the seemingly, ever-broadening, zero sum, exit-based approach to financing early-stage companies.

Therefore, following is a description of why using royalties to finance a startup which has the potential for a successful exit will result in substantially more profit for the founders and a safer, but still excellent profit for the royalty investors.

<><><>

Royalties are an agreed percentage of agreed revenues, for an agreed period, including negotiated terms and conditions

Let’s assume that the business founding individual or group estimate that it will take 2 or 3 years before revenues are received and require $5.0 million in funding before there is likely to be an exit. Further, assuming the project is successful in completing a proof of concept product, which favorably impresses a prospective acquirer, a possible exit value for the company, in cash or stock of the acquirer, could be in a range of $50.0 to $100.0 million, depending on the terms of the deal. That’s the dream and, in the minds of the founders, the likely result of their creativity and effort.

Venture capital firms and other investors in startup companies look for homerun returns in every deal they do, as they need exceedingly high profits from the winning investments to make up for the usually greater number of losing investments. Therefore, the equity-related investor is likely to demand, in deal terms, at least a 5-fold return in the 3-year period, which is a 71% Internal Rate of Return (IRR). This means that $25.0 million of the $50.0 million exit value would be paid the equity investors, leaving the balance of the exit value to be received for division amongst the founders. Still, a good deal for all concerned.

A better deal for the founders would be selling to a royalty investor 10% of the company’s revenues until the investor had received $5.0 million in royalty payments and then 5% of the company’s revenues for the balance of a 20-year royalty, with no equity-dilution.

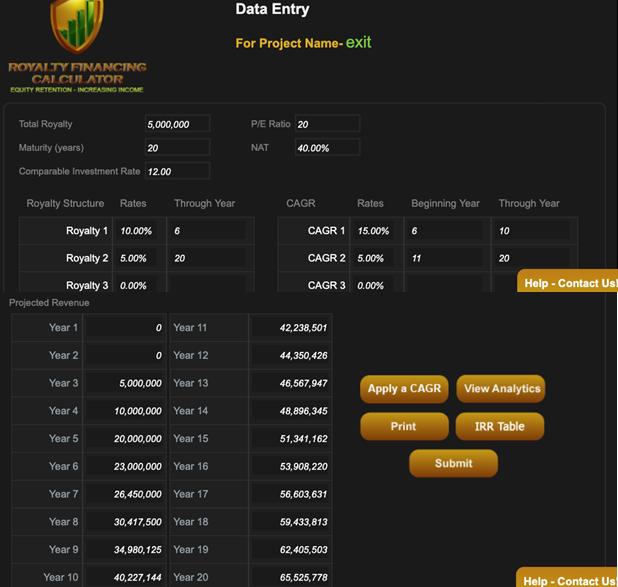

Here is what the REX-Basic.com website calculator shows for “exit” re input data:

As will be noted in the above sample, without having any input from the company, I used zero revenues in the first two years, then revenues of $5.0 million in the 3rd year with 100% growth in the 3rd through the 5th years, and then only a 15% Compound Annual Growth Rate for revenues in the 6th through the 10th year and 5% for the remaining 10 years.

Also assumed was a 40% Net After Tax (NAT) profit margin and a publicly traded, comparable company Price/Earnings Ratio of 20.

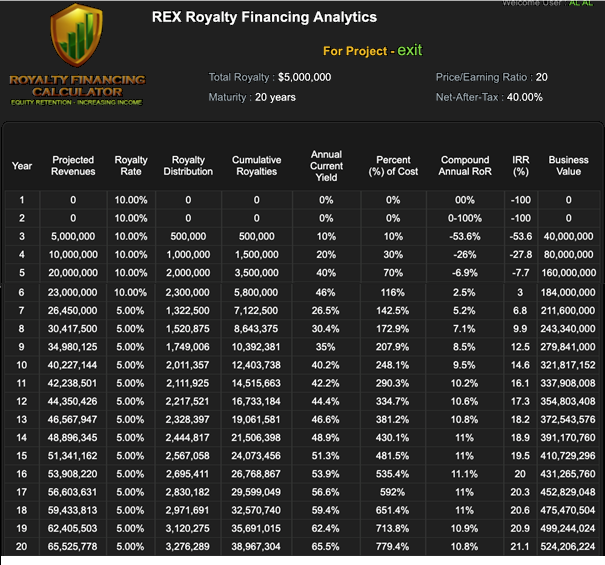

All of these assumptions can and should be modified to permit the calculator to display the results. Using the guessed at data here are the Analytics for exit:

The net result of the exercise is the investor recaptures the invested capital in the 6th year and benefits from more than a 20% IRR over the course of the royalty payment period, even using revenue growth which is likely to be very much lower than the company would project.

It is also noted the founders, who in this scenario, have invested no cash, received compensation , benefitted from health and retirement plans and possibly other perks and end up owning all of a business having an estimated business value of over $500 million.

This could be something like a result of the $5.0 million royalty purchase enabling the successful development of the royalty issuing company. However, it is highly unlikely, as the terms of royalty agreements we recommend contain an issuer’s right of redemption, which successful companies will likely exercise. It will probably be exercised because either the acquiring company, underwriters of investment offerings, or the companies themselves will seek to repurchase the royalties using direct negotiation or tenders and the right of redemption as a last resort, due to the fact that every royalty payment is an equal reduction in pre-tax profit.

The terms of the redemption can be multiples of investor cost, less perhaps time-weighted received royalty payments. For example, if the redemption was exercised within 5 years the multiple could be 5 times, resulting in a minimum of a 38% IRR and if 10 times in ten years a 26% minimum IRR. The actual Reinvested Royalty Rate of Return (RRRR) a concept we have developed and use in our REX-RIAR.com website calculator is based on the fixed rate of interest the investor sets as that which can be obtained for the royalty payments as received. In the same calculator we introduce the features of Credited Royalties, which will offer higher royalty rates, as being different than Distributed Royalties, which distribute payments quarterly, and Self-Liquidating Royalties.

So, in the worst case for the founders of the business having an opportunity to exit within 5 years, the $5.0 million royalty purchasing investors would have received a cumulative $25.0 million or minimum of a 38% IRR, if the deal was a redemption payment of 5 times in 5 years.

When comparing the return to the founders of the business when selling equity to investors versus a royalty it is clear the royalty approach is much better for them, as well as being excellent for the royalty investors.

Those interested in specific situations should contact me because with relatively little data royalty structures can be developed for further consideration:

Arthur Lipper, Chairman

British Far Est Holdings Ltd.

chairman@REXRoyalties.com

858 793 7100

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

Blog Management: Viktor Filiba

termic.publishing@gmail.com