| Year | Revenues | Royalty Rate | Royalty Distribution | Cumulative Royalties | Annual Yield | Percent (%) of Cost | Compound Annual RoR | IRR (%) | Business Value |

| 1 | $50,000,000 | 5.00% | $2,500,000 | $2,500,000 | 25.00% | 25.00% | -75.00% | -75.00% | $90,000,000 |

| 2 | $45,000,000 | 5.00% | $2,250,000 | $4,750,000 | 22.50% | 47.50% | -31.08% | -38.45% | $81,000,000 |

| 3 | $40,000,000 | 5.00% | $2,000,000 | $6,750,000 | 20.00% | 67.50% | -12.28% | -17.91% | $72,000,000 |

| 4 | $35,000,000 | 5.00% | $1,750,000 | $8,500,000 | 17.50% | 85.00% | -3.98% | -6.56% | $63,000,000 |

| 5 | $30,000,000 | 5.00% | $1,500,000 | $10,000,000 | 15.00% | 100.00% | 0.00% | 0.00% | $54,000,000 |

| 6 | $25,000,000 | 5.00% | $1,250,000 | $11,250,000 | 12.50% | 112.50% | 1.98% | 3.93% | $45,000,000 |

| 7 | $20,000,000 | 5.00% | $1,000,000 | $12,250,000 | 10.00% | 122.50% | 2.94% | 6.31% | $36,000,000 |

| 8 | $15,000,000 | 5.00% | $750,000 | $13,000,000 | 7.50% | 130.00% | 3.33% | 7.73% | $27,000,000 |

| 9 | $15,000,000 | 5.00% | $750,000 | $13,750,000 | 7.50% | 137.50% | 3.60% | 8.88% | $27,000,000 |

| 10 | $15,000,000 | 5.00% | $750,000 | $14,500,000 | 7.50% | 145.00% | 3.79% | 9.81% | $27,000,000 |

The terms of royalty contracts are negotiated based on the royalty issuing company’s projected revenues. Company managers are typically highly optimistic about the growth of revenues, made possible by the use of the proceeds of selling a royalty. Sometimes, it all goes well and other times not. This essay describes the likely impact for investors if the terms we recommend are negotiated. The more favorable the terms for the investors the lower can be the royalty rate for the issuer.

We are going to focus on recommended investor protections intended to reduce or possibly eliminate losses, if the projected revenues are not achieved. However, it is also possible that company’s projected revenues and therefore royalty payments, which can be targeted minimums, are achieved and exceeded. Indeed, we have a REXScaledRoyalties.com approach which encourages and rewards companies to make revenue projections much more conservative than they believe will be achieved in agreed periods.

Investors, in assessing the opportunity to buy a percentage of a company’s revenues for a specific agreed number of years on agreed terms, must decide if the company can use the funds being provided to make a product or deliver a service which will have greater value to customers than what is possible with the assets currently available to the company. The investors should also have a positive view of the economic outlook of the company’s customers. In other words, the investor should believe the royalty issuing company will be able to capture a growing share of the market for its product or service and also that their customers will contribute to expanding revenues. Owning a share of a company’s growing revenues, under the right terms, is an investor’s ideal situation and avoids the royalty issuing company’s conflicts of interest, frequently the case in privately owned companies.

Ok, the proverb is that “People plan and the Gods smile” and even in established companies the situation can change, adversely impacting the growth of revenues. Superior competitive products can be introduced, laws and regulations can change, primary customers can become disabled or be reduced by their own problems, key people can leave or become unavailable, or a host of other adverse things can happen.

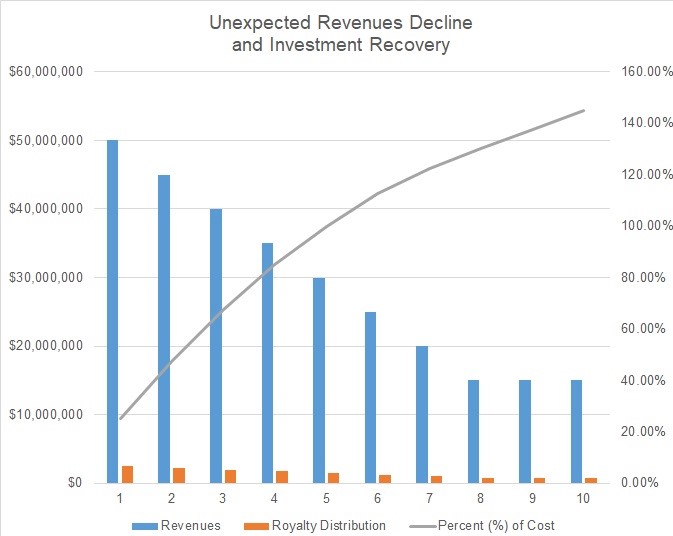

The above chart and analytic table display a company which has been growing its revenues to a point of $50 million in the first year of the investor’s royalty investment, when unexpectedly, for whatever reason, the revenues start to decline, instead of showing the positive revenue growth expected. The chart and table show what might have happened, not what was expected to happen. In the unfortunate situation reflected in the chart and analytic table it will be seen that a 5% royalty rate was sufficient to return the investors capital in 5 years of declining revenue and that in 10 years there was a $4.5 million return over the investor’s $10 million cost. Not a great 10-year return, but a lot better than would be the case for an equity investor in the face of a major reduction of revenues and likely profits.

Aside from the critical assets of the company, without which it cannot operate, which have been pledged or transferred to an independent party required to use those assets for the benefit of the investors in the event the company receives revenues without making the required payments to the investor’s agent, the following arrangements can be put in place:

There can be a third-party guarantor of the royalty payments up to the investor’s cost for the royalty. The guarantor’s liability is terminated when the investor has received in royalty payments the full amount of the cost of the royalty.

There can be an investor’s right to demand the payment, at the end of an agreed period, for the difference between the royalties received and the prorated cost of the royalty.

There can be minimum periodic royalty payments agreed to be paid by the royalty issuing company.

As will be seen REX-RIAR.com (Royalty Issuer Assured) website calculator, minimum royalty payments can be assured. In that same website calculator, the concept of Self-Liquidating royalties is introduced, which though conceived from the discussed Credited royalties, could be used with any royalty format.

Royalties issued by established companies, usually to accelerate revenue and profit growth, have far less risk than investing in royalties issued by early stage companies. The established company royalties are usually structured so the company will make royalty payments to investors resulting in the investors recapturing the cost of the royalty in approximately 5 years. The royalty rate can be reduced after agreed amounts of royalty payments have been made. Also, some investor protections can be modified on receipt of agreed levels of payment.

The reducing revenue chart, which assumes revenues declining from $50 million to $15 million in 7 years would be disastrous for an equity investor but not, in terms of capital loss, for a royalty investor due to the receipt of cumulative royalty payments, even while revenues were in decline. Of course, in the event something happened to severely decrease revenues in the early years, rather than gradually, only an honored guarantee of capital recapture would create a reimbursement of the royalty investor.

The established royalty issuing company should be able, at the time of the royalty issuance, to pay a guarantee fee to an independent party, as a means of reducing the royalty rate required by the investor for risk shifting.

Some well-recognized and rewarded investment geniuses have been able to manage the balance between opportunity and risk acceptance well over the years. However, for most the path to wealth enhancement, is superior income with risk avoidance. Overall, money is not made by losing it.

The inherent advantage of a royalty using our approaches is that first of all, the payment comes “off the top” and is paid when revenue is received by the royalty issuing company. The other advantages are invested capital protective and company policy and practices conflict avoiding.

Diversified portfolios of royalties issued be a wide range of companies should produce superior returns with less risk than otherwise available.

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

For more information please contact:

Arthur Lipper, Chairman British Far East Holdings Ltd.

+1 858 793 7100

chairman@REXRoyalties.com

Blog Management: Viktor Filiba

termic.publishing@gmail.com