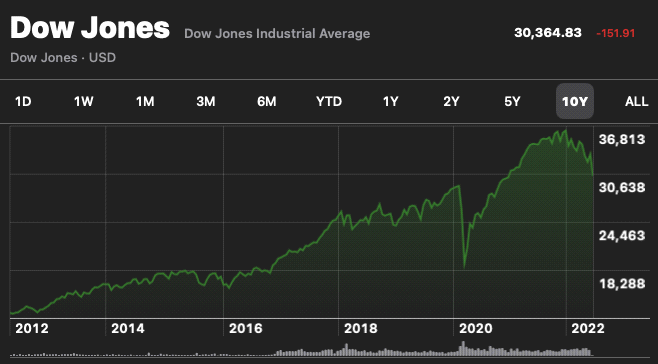

Using the DJIA as reflecting the performance of many larger, established, publicly traded, companies, it is possible to reach the conclusion that the bear market decline since the end of last year has further to go before reaching support levels.

… and for a longer period …

If we take a longer viewpoint, starting with the market movements beginning in the 2008 period of investor enthusiasm, there is a further decline which can now be expected before reaching technical support levels.

A further market decline of 10% or so will not be the end of the world, particularly for capitalists who invest with the objective of value preservation and profit. Their objective is to preserve the value of their discretionary investable assets until the values of investment opportunities are compelling from the perspective of a balance between reward and risk.

Investors will seek to invest in corporate assets which will generate returns and in companies for which there will be predicable customer demands. In many cases, but not all, there is a predictable correlation between revenues and profits, especially for profits sufficient to result in dividend payments. At least in the beginning of the market’s recovery the word, “yield”, will be as much or more motivating than the word, “gain”, which is what drives markets to extremes.

We are dedicated to the belief that royalties are the better form of corporate investment for investors and of financing for company founders and controlling owners who believe in the growth of the future valuation of their companies. It is sort of like buying the milk rather than buying the cow. Royalties are buying a piece of the revenues rather than the company generating the revenues. Many of the benefits of company ownership can be included in the terms of royalties, while still leaving equity ownership in the hands of those making the machinery run.

There are many companies already offering Royalty-Based Financing or Investment (RBF or RBI) in the form or debt-like or related instruments. We can assist prospective royalty issuers and investors in the negotiation of financing terms. We are also able to assist companies in developing a structure for royalties which we believe will be both fair and will satisfy the needs of investors, especially those having related environmental and community interests.

For more information check out my blog arthurlipper.com/, read some of the books and articles I’ve written about royalties, or contact me directly.

Arthur Lipper, Chairman arthurlipper@gmail.com

British Far East Holdings Ltd.