It’s possible, using royalties, for investors to obtain growing income returns and for business owners to obtain capital, without reducing their company ownership.

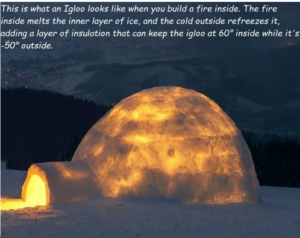

Eskimos build igloos from snow to protect themselves from their frigid environment surroundings.

Investors lose the opportunity to achieve their objectives by automatically avoiding whatever is unfamiliar to them.

The unknown, especially that which involves change, invokes fear of loss.

Embracing significant changes in investment methodology.

The advocacy of change in methodology of investment requires the primary resource of seemingly unlimited patience.

Those who advocate these changes expect significant reward but at the same time they must also overcome the fears expressed by investors.

The advocate’s reward is hoped, by the advocate, to be significant when investor fears are sufficiently assuaged to test the previously unused approach.

We advocate using royalties, instead of equity, to both invest in and finance privately owned companies, and have therefore designed investor protections to provide sufficient comfort to investors so they can test for themselves the risk/reward of royalties.

These investor protections include the following;

transfer or assignment of critical assets of the royalty issuing company to assure contractual compliance,

immediate payment of the agreed royalty upon the royalty issuing company’s receipt of revenue,

royalty issuing company’s purchase price “put”, offering a money-back purchase, at the investor’s option, at the end of an agreed period and

in some cases, required royalty issuer’s annual repurchase of an agreed amount of outstanding royalties at an agreed valuation, with all royalties ultimately redeemed.

Therefore, if royalties issued by a revenue increasing, established company are purchased, risk reducing payments start immediately and at least a portion of the amount invested is sure to be recovered. The fairly intended royalties we structure and recommend will usually return all of the amount invested within 5 years, leaving in the case of a 20-year royalty, 15 years of pure profit to be received from the expected increase in revenues.

Due to the investor protections and assured payment of the agreed percentage of revenues, we believe the risk / reward ratio is generously weighted in favor of the investor.

From the perspective of the business owner, the primary advantage of selling a percentage of revenues versus reducing ownership in the business by selling a percentage of equity, is the ability to obtain capital with which to grow the business while retaining control and ownership. The owner’s benefits include not being subject to the following:

pressure to report ever increasing per-share profits, because royalty investors are solely focused on revenues,

requirement to accept advice or be influenced regarding; terms of executive compensation, pension and share ownership, stag compensation, personnel hiring, sales policies, marketing focus, consultant retention, charitable contributions and membership of the company’s Board of Directors, and

provision of other than an agreed and scheduled amount of data regarding company activities, other than revenues, with access to company executives being confined to that agreed.

The business owner’s second most important advantage from the use of the royalties we design and recommend is the redemption right in the royalty agreement. Although, it will be expected that the royalty issuing company will be interested in reacquiring the issued royalties during the period that they are outstanding, due to the fact that all royalties paid by profitable companies would be additional pretax profits, if not paid. The royalty issuing company may attempt to negotiate directly with individual royalty investors or may make tender offers to all of the royalty investors. Also, the issuer’s right of redemption, which will be most likely exercised in the case of the issuer: being acquired, arranging a new financing, making a public offering or having excess cash flow, on terms negotiated at the time of the sale of the royalty. This worst case ability, to eliminate the royalty payment obligation is of enormous benefit to the business owner.

Therefore, both the investor and the business owner are demonstrably better served by using a royalty as the means of investing and business financing, than the purchase or sale of equity.

For more information contact me or see REX-Basic.com or obtain through http://Amazon.com Off The Top and/or Revenue Royalties and read my Journal http://arthurlipper.com

© Copyright 2019 British Far East Holdings Ltd. All rights reserved.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

chairman@REXRoyalties.com

858 793 7100

Blog Management: Viktor Filiba

termic.publishing@gmail.com