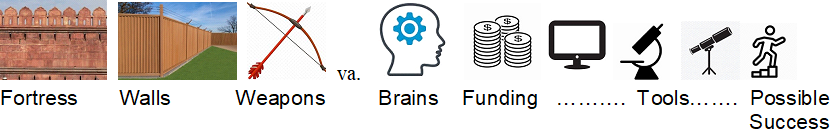

In our highly volatile economic and market environment, the relatively smaller number of people who own substantial assets are understandably focused on protecting their intellectual and real property. The greater number of other people, who naturally want to create more assets to protect, need the services of those having relevant education, business funding at fair terms, use of the necessary tools for technological development, and a positive socio-economic environment.

Protection of existing intellectual property rights may, but does not need to, restrict the process of wealth creation. Patent periods can be changed, and those owning patents can be encouraged to collaborate with those having newer concepts for improving the benefit of using that which has been patented.

Taxation at all levels can be structured to encourage those choosing to accept the risk of funding new ventures, especially in areas which benefit the public.

Motivated people, who have been appropriately educated or are intuitively talented, are necessary for the creation of products and services which can be produced and profitably marketed to customers. Investor funding is necessary for them to benefit from the development and provision their products and services.

Selling revenue royalties (royalties) to investors is a pre-revenue company’s most advantageous and fairest means of financing the growth of their business. The investor of the royalty bought from the company owns an agreed percentage of the company’s defined revenues for an agreed period, on terms which meet the needs of both the investor and company founders. We can assist in both structuring the royalty and negotiating its terms.

We recommend that the royalties we structure contain an Issuer’s Right of Redemption, permitting the royalty payment obligation to be terminated on terms agreed at the time the royalty is sold to the investor.

The royalty investor owns no part of the company generating the revenues, a percentage of which is to be paid the investor, usually on receipt of revenues by the company. Therefore, the investor is not concerned about executive compensation, the declaration of profits or other factors impacting a valuation of the company.

The royalty payments made by the company are deductible from the company’s federal income tax, and are tax-free from federal income for the investor, until the investor has recaptured the full amount invested in the royalty. Thereafter, royalty payments are considered ordinary income.

In all cases involving financing transactions, the royalty issuing company should use the services of both an attorney and tax advisor, with whom we will be pleased to cooperate.

A price/earnings ratio is the multiple which determines the market valuation of the company. The P/E also indicates the number of years of the company’s current earnings which would cumulatively be necessary for the amount to equal the valuation of the company, as reflected by the current price of the stock. A P/E of 30 indicates a market valuation of 30 times the last 12-month’s EPS and is also indicative of it requiring 30 years of the company’s latest EPS to equal the valuation of the company as reflected in the price of the stock. The justification of high P/E’s is the belief and bet by investors that the EPS of the companies will be very much higher in the future than is currently the case.

We believe that early-stage company investors will be better served by the opportunity to recapture their investment principal in 5 to 7 years, with multiple additional years of revenue sharing, assuming projected revenue levels are achieved, in comparison with their eventual need to sell shares of the company, with only the possibility of recapturing capital, and possibly a profit.

Arthur Lipper, Chairman arthurlipper@gmail.com

British Far East Holdings Ltd.